Bitcoin, the enigmatic digital currency, is once again capturing headlines as it surges in price over the past months. Amidst the unfolding narrative of 2024, two pivotal events command attention: the advent of spot Bitcoin ETFs and the impending halving. While each event holds promise, their convergence presents a nuanced scenario with the potential for significant impact on the digital asset’s landscape.

Spot Bitcoin ETFs: A Path to Mainstream Acceptance?

The recent approval of spot Bitcoin ETFs has been hailed as a major win for mainstream adoption. They offer investors a regulated avenue to Bitcoin exposure, without the complexities associated with direct crypto ownership.

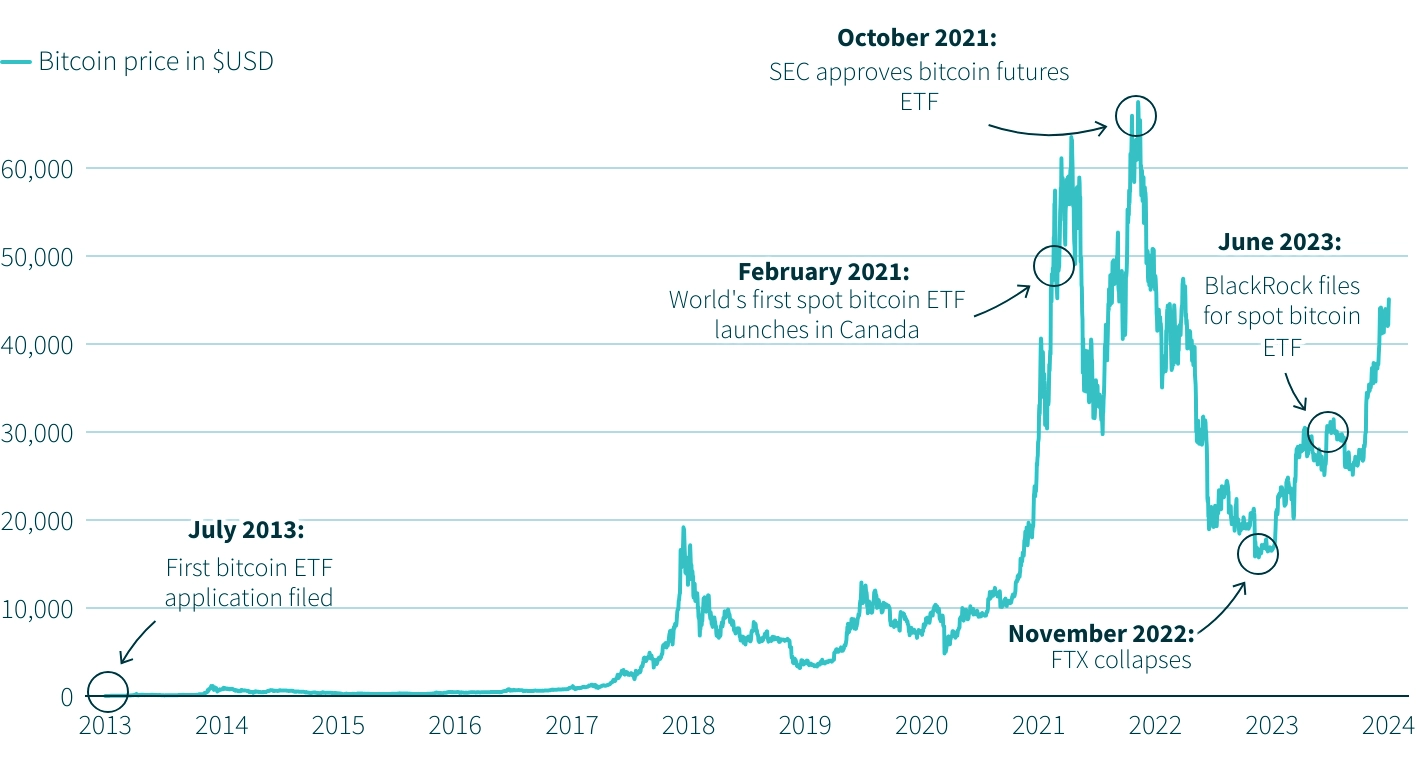

Exhibit 1: Events Leading up to the First Spot Bitcoin ETF

Source: LSEG, Reuters Graphics

January 10, 2024 marked a significant milestone in the cryptocurrency market as the SEC approved the first U.S.-listed exchange-traded funds (ETFs) to track bitcoin. This regulatory approval could signal a turning point, enticing large institutions and traditional investors into the market, potentially amplifying demand and driving prices upward.

However, there are differing perspectives on the actual impact. While some foresee increased demand leading to price surges, others caution that ETFs could introduce liquidity that may offset scarcity, potentially tempering price appreciation. Furthermore, the composition of some ETFs, which may rely on futures contracts rather than actual Bitcoin, could further complicate the relationship between ETF prices and genuine supply-demand dynamics.

Understanding Bitcoin’s Price Dynamics

Bitcoin’s price history is marked by remarkable volatility, characterized by periods of exponential growth and sharp corrections. The rally from $45,000 to $69,000 in 2021, accompanied by a surge in open interest in the futures market, underscores the role of investor sentiment and market dynamics in driving price fluctuations.

Exhibit 2: Bitcoin Price Trends (2021 – February 16, 2024)

Source: CoinmarketCap

As of February 15, 2024, Bitcoin’s price has surged close to $53,000, marking a notable increase from previous levels. This recent uptick is attributed in part to the influx of institutional capital through spot Bitcoin ETFs.

Data from Coinglass indicated that the open interest in the futures market stood at $23.85 billion, which is close to the $24 billion record high reached in mid-November 2021 when Bitcoin hit all-time highs above $69,000.

The impending Bitcoin halving event is also set to play a pivotal role in driving investor interest.

The Halving: Scarcity Meets Increased Demand?

Every four years, Bitcoin undergoes a halving event, reducing the number of new coins awarded to miners for verifying transactions. This mechanism occurring every 210,000 blocks is designed to maintain scarcity and combat inflation, creating predictable supply shocks. As the rate of new coin issuance decreases, the theory suggests that increased demand could drive prices upwards.

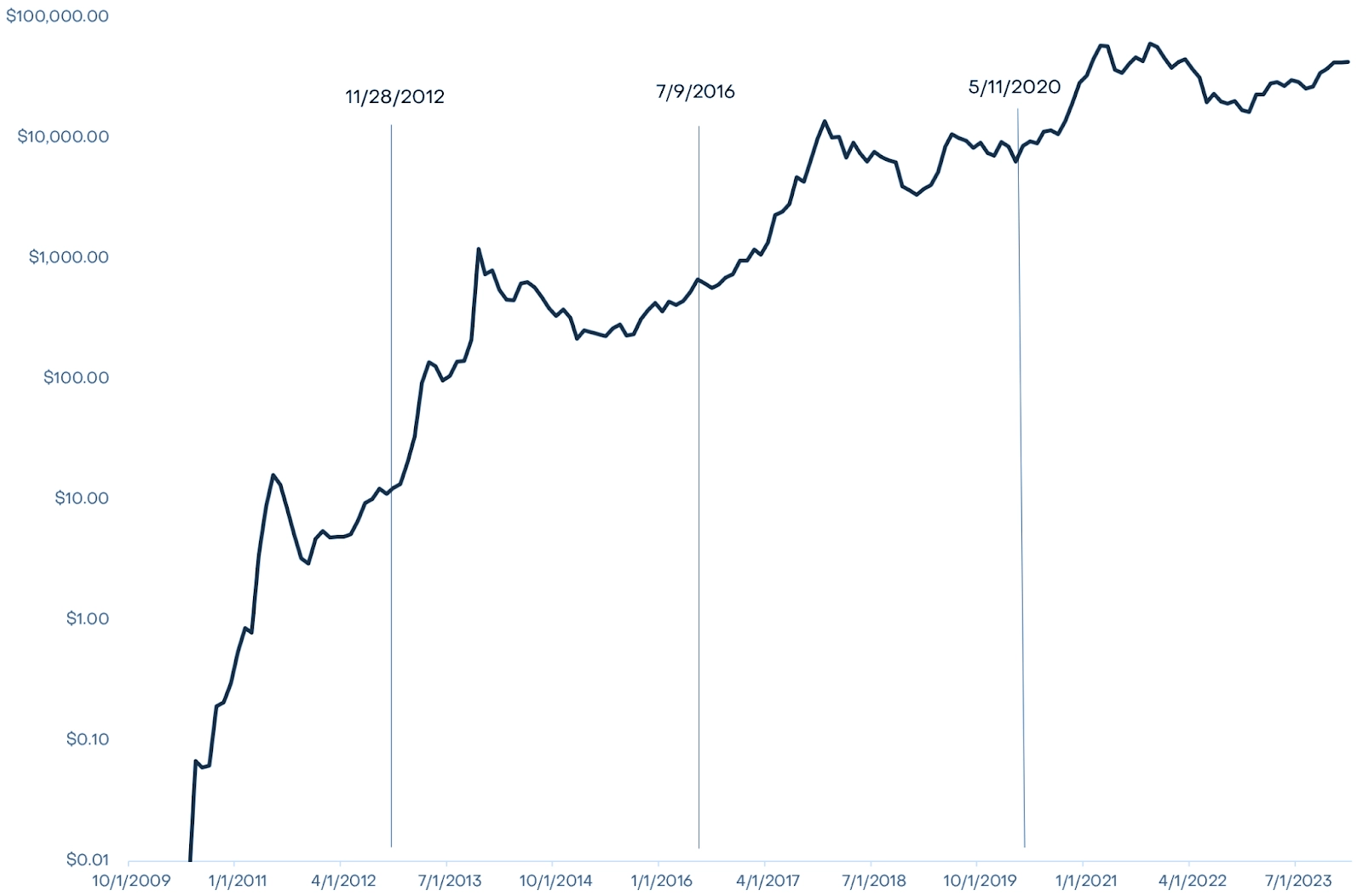

Exhibit 3: Bitcoin’s Price Tends to Increase Post-Halving

While we anticipate the fourth halving event, slated to happen at block-height 840,000, pinning down the exact date and time proves challenging due to the inherent variability and probabilistic nature of mining blocks. However, industry consensus points to an estimated date of April 23, 2024. While previous halvings have coincided with significant price increases, it’s essential to recognize that past performance does not guarantee future outcomes. The evolving dynamics of the market suggest that this time around, the equation is more complex.

The Interplay: A Mixed Bag of Possibilities

In the past, the price movements of alt-coins have consistently trended alongside Bitcoin’s, creating a complex interplay within the cryptocurrency market. As Bitcoin approaches its halving event, coupled with the introduction of spot Bitcoin ETFs and the emergence of Ordinals NFTs on the Bitcoin blockchain, several key factors come into play, shaping market sentiment and potential outcomes.

Synergy: The convergence of spot Bitcoin ETFs and the impending halving could ignite a perfect storm for Bitcoin’s price surge. With ETFs offering institutional investors an easy route to Bitcoin exposure and the halving reducing supply, the combination could trigger unprecedented demand-supply dynamics, potentially leading to a significant price rally.

Dampened Effect: However, the influx of liquidity from ETFs might counterbalance the scarcity-driven price surge expected from the halving. While ETFs democratize Bitcoin investment and broaden market participation, the increased supply of derivative products could dilute the scarcity premium, tempering the magnitude of price appreciation.

On-Chain Activity and NFTs: The emergence of Ordinals NFTs on the Bitcoin blockchain is indeed notable, contributing to increased on-chain activity and miner revenue. According to Grayscale, over 59 million NFTs were created as of February 2024, generating upwards of $200 million in transaction fees for miners. This surge in on-chain activity not only contributes to the overall health and security of the Bitcoin network but also provides additional revenue streams for miners.

Volatility: The interplay between different forces could create periods of high volatility. As investors navigate the uncertainty surrounding ETF adoption, the halving’s impact on supply, and the evolving NFT landscape, abrupt price swings in both directions are likely, presenting both opportunities and risks for market participants.

Conclusion: Navigating Bitcoin’s Ever-Evolving Landscape

Bitcoin’s resilience and adaptability in the face of changing market dynamics underscore its enduring relevance and potential for long-term value creation. While uncertainties abound, the fundamental strengths of Bitcoin as a store of value and hedge against inflation remain intact. As we traverse the ever-evolving landscape of cryptocurrency, prudent decision-making, informed by thorough research and a long-term perspective, will be key to unlocking Bitcoin’s full potential as a transformative asset class.

Investors should remain vigilant, exercise diligence, and embrace the inherent volatility of the cryptocurrency market. By staying informed and adopting a disciplined approach, investors can position themselves to navigate the challenges and capitalize on the opportunities that lie ahead in Bitcoin’s journey towards mainstream acceptance and adoption.

This article is for informational purposes only and should not be considered financial advice. The content provided herein does not constitute investment recommendations, legal advice, or professional financial guidance. All investment decisions should be made based on the individual’s own assessment of their financial situation, risk tolerance, and investment goals.

It’s essential to recognize that past performance is not indicative of future results. While historical data and trends can offer insights into potential market movements, they do not guarantee similar outcomes in the future. The cryptocurrency market, including Bitcoin, is known for its inherent volatility and unpredictability. Therefore, investors should exercise caution, conduct thorough research, and consult with a qualified financial advisor before making any investment decisions.