A New Phase in AI Stocks

As we enter 2025, the global AI investment landscape is undergoing a notable shift. For years, the “Magnificent Seven”—Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla—have dominated the stock market, leveraging AI to drive growth. However, China’s “Terrific Ten” are rapidly gaining ground, showing a surge in investment and innovation.

The question remains—Is this a true shift in global AI leadership, or just a short-term catch-up fueled by government policy and market enthusiasm? While China’s tech giants are investing heavily in AI and semiconductor independence, U.S. AI leaders still maintain a stronghold in core research and innovation.

China’s Terrific Ten: The Rising AI Giants

While the Mag 7 have traditionally captured investor attention, China’s AI sector has rapidly evolved, giving rise to the “Terrific Ten.” These companies are at the forefront of AI innovation across various industries:

Baidu (BIDU): China’s leader in AI-driven search engines, autonomous driving, and cloud computing.

Tencent (TCEHY): A gaming and social media giant incorporating AI-driven recommendations and virtual assistants.

Alibaba (BABA): A global e-commerce leader expanding into AI-powered cloud computing, logistics, and fintech.

Xiaomi (1810.HK): AI-integrated consumer electronics and smart devices.

Netease (NTES): A major player in AI-driven gaming, music streaming, and cloud services.

Xiaomi (1810.HK): AI-integrated consumer electronics and smart devices.

iFlytek (002230.SZ): A leader in voice recognition and natural language processing.

Meituan (3690.HK): An AI-driven logistics and food delivery company utilizing automation and robotics.

JD.com (JD): One of China’s largest e-commerce firms, investing heavily in AI-powered logistics.

Geely (0175.HK): A major Chinese automaker incorporating AI into smart vehicle systems, autonomous driving, and next-generation EV technology.

BYD (002594.SZ): An electric vehicle manufacturer integrating AI into smart vehicles and autonomous driving.

Hikvision (002415.SZ): A major global supplier of AI-powered surveillance and security systems.

SMIC (0981.HK): China’s semiconductor backbone, crucial for domestic AI chip production.

Stock Market Performance: China’s Terrific Ten vs. U.S. Magnificent Seven

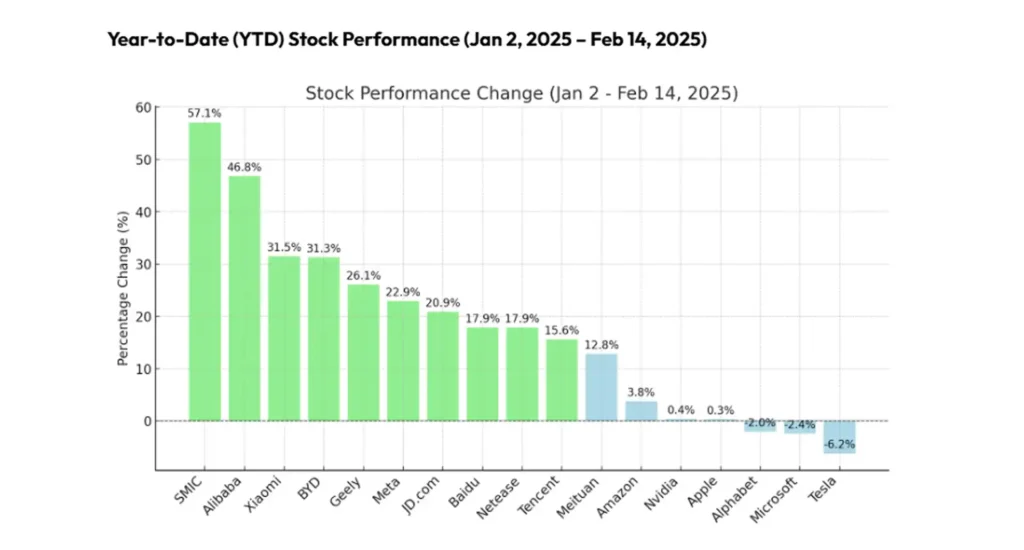

Year-to-Date (YTD) Stock Performance (Jan 2, 2025 – Feb 14, 2025)

The above chart highlights the percentage change in stock prices for major AI-driven companies in China and the U.S. since the start of 2025:

China’s AI stocks surged ahead, with SMIC (+57.1%), Alibaba (+46.8%), and Xiaomi (+31.5%) leading the rally. These gains reflect growing investor confidence in China’s semiconductor and AI ecosystem.

JD.com (+20.9%), Baidu (+17.9%), and Tencent (+15.6%) also posted strong returns, signaling that Chinese tech firms are gaining ground in AI applications and cloud computing.

U.S. AI stocks had mixed results—Meta (+22.9%) and Amazon (+3.8%) saw gains, while Microsoft (-2.4%), Alphabet (-2.0%), and Tesla (-6.2%) struggled.

Apple (+0.3%) and Nvidia (+0.4%) remained stable, but faced limited upside amid broader AI market shifts.

With China’s AI sector gaining ground, its Terrific Ten are increasingly positioning themselves as serious contenders in the global AI race.

What’s Driving China’s AI Stock Surge?

1. Robust Government Support

China has positioned AI dominance as a national priority, injecting substantial funds into AI research, infrastructure, and semiconductor independence under the “Made in China 2025” initiative. This state-backed support offers Chinese AI firms financial stability and growth opportunities that their Western counterparts may lack.

2. Surging Domestic AI Adoption

AI adoption in China is accelerating, driven by demand for automation in sectors like retail, logistics, and urban development. Unlike Western markets, where AI applications are often confined to software and cloud computing, China is embedding AI into tangible industries, from robotic warehouses to AI-enhanced public surveillance systems.

3. Progress in AI Chip Self-Reliance

In response to U.S. sanctions limiting access to high-performance AI chips, China has invested heavily in domestic semiconductor manufacturing. Companies like SMIC and Huawei have made significant strides in AI chip production, reducing reliance on foreign suppliers.

4. Innovative AI-Driven Business Models

Firms such as JD.com and Meituan are integrating AI into their logistics networks with remarkable efficiency. Meituan’s AI-driven delivery systems and JD.com’s automated warehouses exemplify how AI is revolutionizing traditional industries. Simultaneously, BYD’s advancements in AI-driven autonomous driving are positioning it as a formidable competitor to Tesla in the electric vehicle market.

5. Market Rotation and Valuation Dynamics

While the Mag 7 stocks have reached high valuations, making them less appealing for growth-focused investors, Chinese AI firms, previously undervalued due to geopolitical concerns, are now attracting increased interest as their potential becomes more evident.

DeepSeek: A Sign of China’s Growing AI Ambitions

A notable development in China’s AI landscape is the emergence of DeepSeek, a startup that has recently launched a cost-effective large language model (LLM) and AI search engine, aiming to compete with OpenAI and Google. This breakthrough has not only spurred a rally in Chinese tech stocks but also positioned DeepSeek as a significant player in the AI sector. The company’s innovations have led to increased investor interest and have prompted discussions among global tech leaders about the competitive dynamics in AI.

Challenges to Sustaining China’s AI Growth

Despite the current momentum, several challenges could impact the long-term dominance of China’s AI sector:

Regulatory Uncertainty: The Chinese tech industry has previously faced sudden regulatory crackdowns, affecting major players like Alibaba and Tencent.

Geopolitical Tensions: Ongoing trade disputes and sanctions on AI-related technologies could hinder China’s AI progress.

Market Volatility: The recent surge in tech stocks is partly driven by speculative investments, leading to potential volatility and caution among global investors.

The Road Ahead: Can China’s AI Sector Sustain Its Momentum?

China’s AI sector is on the rise, challenging U.S. dominance in key areas like cloud computing, automation, and AI-driven applications. Strong stock performance, government-backed funding, and widespread AI adoption signal major momentum, but whether this translates into long-term global leadership remains uncertain.

While China is making rapid progress in AI commercialization, the U.S. still leads in core AI research, chip innovation, and global influence. The coming years will determine whether China’s AI sector can evolve beyond government-driven growth and truly rival the Mag 7 in shaping the future of AI.

Looking ahead, key factors to watch include:

✔ China’s ability to develop advanced AI chips without U.S. technology

✔ The expansion of AI beyond China’s domestic market into global applications

✔ Regulatory stability and how government policies impact AI firms

✔ The response from U.S. AI leaders—whether they will accelerate innovation to maintain dominance

Rather than a simple race for stock market performance, the real competition will be about influence, innovation, and the ability to scale AI on a global level. Whether China takes the lead or remains a powerful challenger will shape the next phase of AI-driven transformation worldwide.

This article is for informational purposes only and does not constitute financial or investment advice. Stock market performance is subject to market risks, regulatory changes, and economic conditions. Investors should conduct their own research and consult with a professional advisor before making any investment decisions.