On May 16, 2025, Moody’s Ratings downgraded the United States’ long-term credit rating from Aaa to Aa1, marking the first time in history that all three major credit rating agencies have removed the U.S. from their top-tier status. This move has reverberated through global markets—not because it was entirely unexpected, but because it confirms a deeper, more persistent concern: that the world’s largest economy is grappling with long-term fiscal imbalances and political gridlock that no longer escape scrutiny.

This development doesn’t point to an imminent crisis. But it does mark a symbolic shift in how markets, policymakers, and businesses must think about U.S. economic reliability—and what that means for capital flows, financial planning, and systemic trust globally.

Why the Downgrade Matters

This isn’t the first time the U.S. has been downgraded. S&P removed its AAA rating in 2011, Fitch followed in 2023, and now Moody’s has closed the loop. The reasons, however, have become harder to ignore:

Persistent fiscal deficits are expected to exceed 6% of GDP over the coming decade.

Federal debt has risen to over $36 trillion—more than 120% of U.S. GDP.

Interest payments alone are now over $1 trillion annually, surpassing defense spending.

Political dysfunction, particularly around debt ceiling standoffs and budget impasses, has made structural reform unlikely in the near term.

Moody’s didn’t signal immediate financial instability. Rather, it flagged a “material erosion” in the country’s fiscal strength—one that will make navigating future recessions or emergencies more challenging.

Global Implications

While the downgrade doesn’t trigger automatic changes in central bank policies or institutional mandates, it carries practical consequences for market sentiment and capital allocation:

1. A Subtle Shift in Risk Perception

U.S. Treasuries have long been treated as the world’s “risk-free asset.” Even with the downgrade, that perception hasn’t collapsed—but it’s been nudged. For institutional investors, especially sovereign wealth funds and pension plans, this may introduce a more cautious weighting of U.S. government exposure in portfolio models.

2. Ripple Effects on Currency and Interest Rates

Yields on longer-dated Treasuries have risen in response to the downgrade, contributing to global rate volatility. For economies and corporations that borrow in U.S. dollars, especially in emerging and import-dependent markets, the impact may be felt in the form of tighter external financing conditions.

3. Capital Flow Rebalancing

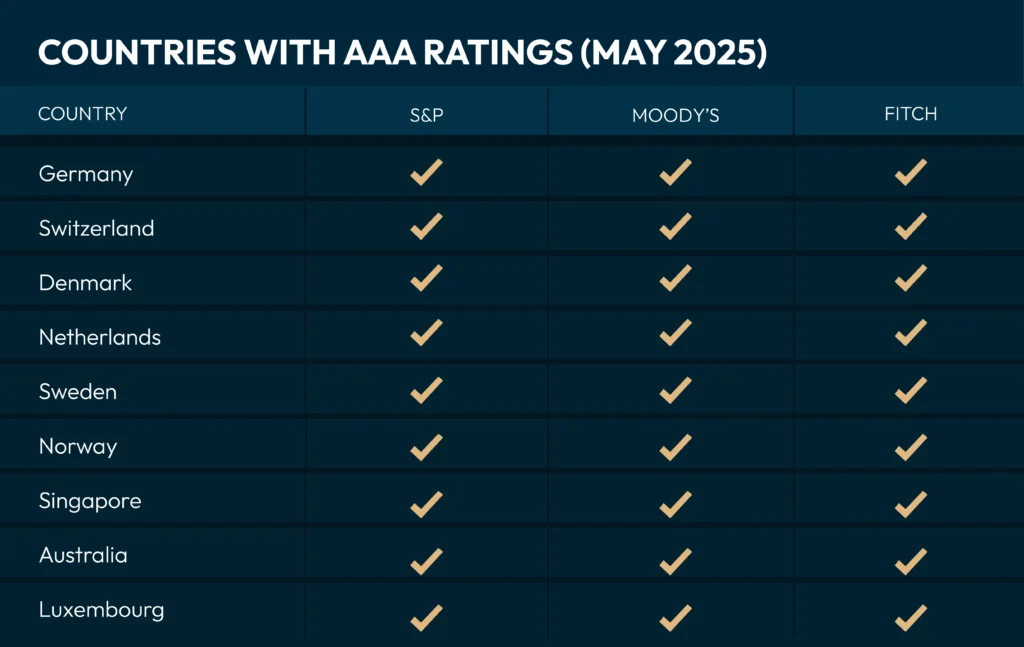

While there’s no immediate exodus from U.S. assets, the downgrade could accelerate a gradual diversification trend—particularly toward AAA-rated alternatives.

Their relative fiscal discipline may make them more attractive in times of uncertainty.

4. Pressure on Global Fiscal Governance

The U.S. downgrade may also spark reflection elsewhere. Governments running high deficits may face increased scrutiny from rating agencies and markets alike. For international businesses, this makes sovereign credit profiles an increasingly relevant backdrop to strategic planning.

What Businesses Should Take Away

This is not a signal to panic—but it is a prompt to reassess assumptions. For business leaders and investors:

Review exposure to U.S. dollar-denominated debt and assets—particularly where funding costs are sensitive to yield movements.

Factor in the possibility of sustained U.S. fiscal uncertainty in long-range planning models.

Monitor other sovereign credit ratings—credit downgrades can have cascading effects on supply chains, insurance, and regulatory capital requirements.

Prepare for greater market volatility as fiscal signals and rating events gain more influence over asset pricing.

Closing Thought

The U.S. remains a global economic anchor, but Moody’s downgrade serves as a caution: no nation is exempt from long-term accountability. The global financial architecture is entering a phase where reputational credit—and not just creditworthiness—can influence market stability. For businesses, vigilance and adaptability remain the most valuable forms of capital.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, legal, or other professional advice. The views expressed are neutral and reflective of currently available data as of the publication date. Readers should consult qualified professionals before making decisions based on this information.