As we step into 2024, the stablecoin market continues its transformative journey, balancing stability, regulatory scrutiny, and unprecedented innovation. A glance at the events that shaped 2023 sets the stage for the intriguing dynamics expected in the year ahead.

Resilience Amidst Challenges

The resilience exhibited by the stablecoin market in the face of 2023’s turbulence is nothing short of commendable. From the discontinuation of Binance’s BUSD to the de-pegging events involving stalwarts like USDC and DAI during the March banking crisis, challenges were met with unwavering resilience.

Despite the hurdles, stablecoins, often regarded as barometers of crypto market health, displayed an encouraging upward trend. This signals not only improved liquidity but also a surge in on-chain capital deployment.

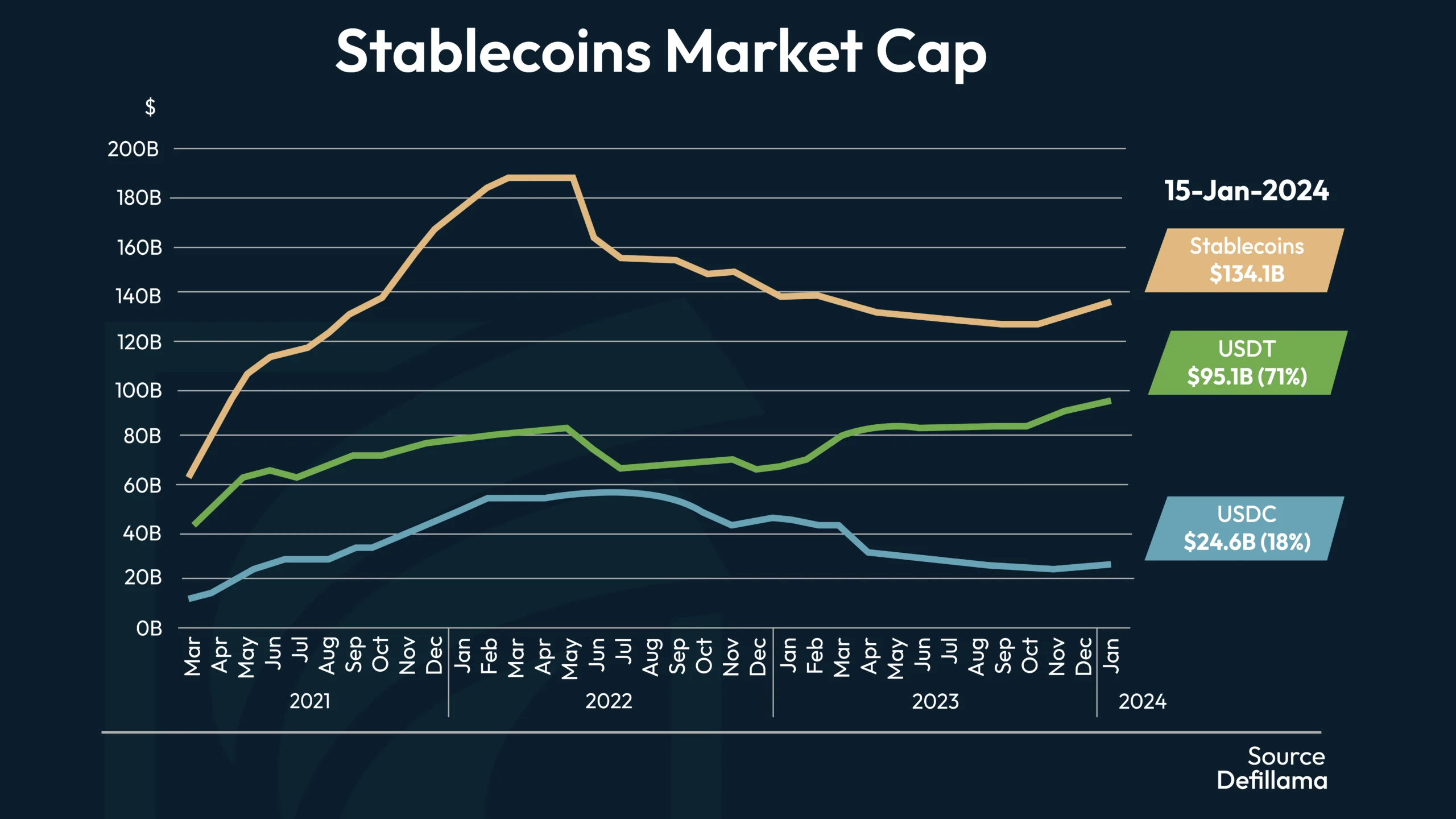

As of January 15, 2024, the dominance of USDT stands at an astonishing 71%, commanding a market capitalization of $95.1 billion — its highest ever. USDC follows with 18% ($24.6 billion). This dominance showcases investor trust in these stablecoins, serving as a testament to their robustness amid market volatility and laying the foundation for the ongoing bullish narrative.

However, the journey has not been without challenges, with USDC’s market capitalization experiencing a significant dip from its peak in June 2022 to just over $24 billion in January 2024. The reasons range from the U.S. banking crisis to regulatory hurdles. Despite this, Circle’s State of the USDC Economy report paints a positive picture. It reveals a 59% surge in the number of wallets holding over $10 of USDC in the past year, reaching a total of 2.7 million. This surge in wallet numbers showcases the enduring appeal of stablecoins, demonstrating their resilience and continued popularity within the broader cryptocurrency market.

Innovation at the Helm

Innovation remains a driving force in the stablecoin industry, serving as a connection between conventional finance and blockchain technology. As we look ahead to 2024, stablecoins continue to play a crucial role in the larger financial landscape, especially when it comes to cross-border transactions and settlements.

Regulatory Landscape: A Pivotal Transformation

The regulatory landscape for stablecoins underwent a significant transformation in 2023. The Financial Stability Board’s recommendations for comprehensive regulation and oversight of global stablecoin arrangements marked a pivotal moment. The G20’s adoption of a crypto roadmap and regional efforts in the U.K., the European Union, Japan, Singapore, and Hong Kong reflect a global commitment to managing stablecoins within the international financial system.

Major corporations such as Visa, Mastercard, and Checkout.com embraced stablecoins across various applications, highlighting the increasing acceptance of these digital assets in mainstream financial operations.

Outlook for 2024: Stability, Innovation, and Regulatory Clarity

Looking towards the future of 2024, stablecoins are on the brink of experiencing even more expansion and advancement. The durability of this sector, combined with the continuous development of regulations, establishes stablecoins as a vital tool within the world of cryptocurrency.

Institutional adoption, evidenced by major financial institutions investing in stablecoin applications, is expected to continue driving stability and efficiency in financial transactions. With the rise of low-volatility assets, the sector is responding to market demands for reduced risk exposure and increased stability.

Overcollateralization, transparency, and diversification of stablecoin collateral will become key pillars, ensuring the sustainability of digital assets. The dominance of dollar-based stablecoins is anticipated to persist, driven by the global influence of the U.S. dollar.

In the future, there is a growing trend towards the development of local currency stablecoins, which aims to connect traditional and digital finance, encouraging wider acceptance and use. As the stablecoin market deals with regulatory challenges and advances in technology, it is expected that by 2024, it will become more mature, focusing on stability, security, and seamless integration into the global financial system.